New build costs ireland: How much does it cost to build a house in Ireland in 2022? – Dooley Cummins Architects & Engineers

How much does it cost to build a house in Ireland in 2022? – Dooley Cummins Architects & Engineers

How long is a piece of string?

As this is the single biggest investment most of us are likely to make, it is important that you are confident that your hard-earned (or borrowed) cash will be well spent. The costs of building residential houses and extensions are challenging to determine as there are many variables such as:

- Location

- Size

- Site conditions

- Number of rooms and storeys

- Kitchen and bathroom fitting designs

- Availability of contractors

The above items are just some of the factors to be considered. It can be a bit like buying a car e.g., are you going for a top of the range model

or a secondhand classic?

Where do I start?

As a starting point, the key issue will be the floor area of your new home or extension. This is where clever design can cut costs to ensure every square millimeter (or inch) is utilized and non-habitable space such as circulation corridors are minimized.

One thing we can be sure of telling you is that you cannot build a house in 2022 for the oft-quoted figure of €100 per square foot which probably dates from the last century. Even a self-builder could not deliver a new home, compliant with all current Building Regulations for that rate. If friends, who built houses, tell you otherwise, don’t believe them. Most people forget to include lots of things they had to fork out on like septic tanks and pre-construction outlays.

Precedents

Based on tenders we received for new houses in the first quarter of 2022, a more realistic figure for building a one-off detached house in a rural area would be in the region of €2,250 per square meter (€210 per square foot). This figure would include having the work undertaken by a main contractor and VAT. It would also be based on a turn-key finish – ready to move into.

It would not include site purchase costs, Development Levies (€2,000 – €20,000 depending on the floor area and what Co.

The latter item reared its ugly head during 2021 because of construction personnel shortages, material shortages, Brexit-related delivery issues and of course, the pandemic. This led to an increase of up to 30% in building costs in some areas. It will be interesting to see if prices show a downturn during 2022 as some of these issues level off.

On 7th June 2022 BNP Paribas Construction Purchasing published its index for May which shows that cost pressures were “severe” in April 2022, the second-fastest rise in input prices since the survey began in June 2000, just behind the record posted in October 2021.

Annual inflation for building and construction materials was running at 18.2 per cent in April, whereas annual inflation for some materials such as metal and wood ranged between 50 per cent and 60 per cent.

In addition, average hourly total labour costs increased by 15.2 per cent in the construction sector during the first quarter of 2021 compared with a 4.

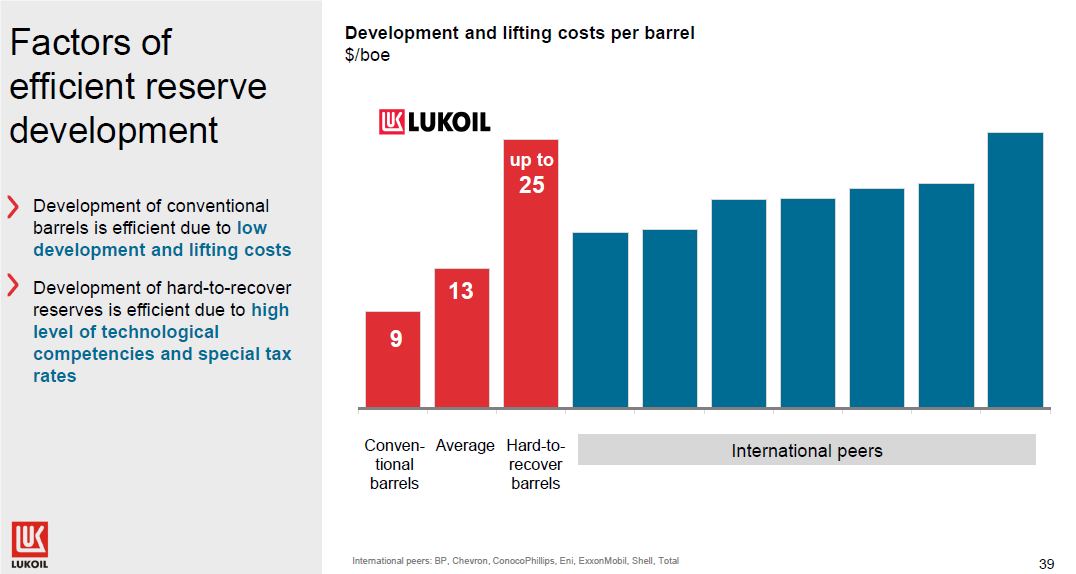

The Royal Institute of the Architects of Ireland (RIAI) publish a consumer guide, Building/Construction Cost Guidelines which give gave indicative figures in 2019 as per the diagram below. The Society of Chartered Surveyors Ireland (SCSI) publish details on Tender Price Index Figures in 2021.

SELF-BUILD

We strongly recommend careful consideration is given before embarking on a self-build / Direct Labour build if the intention is to try and reduce costs. This approach is not for the faint-hearted and should not be undertaken by anyone who does not have prior experience in the construction sector. The regulatory environment in which building is monitored has become increasingly complex and you do not need to discover a problem at the end of the project in obtaining certification.

You also need to estimate the cost and availability of your own time. A building project cannot be realistically managed by anyone with a nine to five, Monday to Friday job.

BUDGETING

You may have assembled a huge scrapbook or Pinterest file of desired interior and exterior images, but it is good to bring an element of practicality to the process. A good start is to assess your pre-construction outlays rather than just focusing on the building cost as these can mount up and you will need to fund these yourself before a mortgage kicks in. These could include:

- Site purchase costs

- Stamp Duty

- Land Registration fee

- Gift Tax (if receiving a site from a relative)

- Site survey / marking out fee

- Site Valuer fees (for a mortgage)

- Solicitor’s fees

- Architect’s fees

- Specialist consultant fees e.g., archaeologist or flood risk assessment depending on the site

- Planning application costs

AND FINALLY….

PROFESSIONAL FEES

Trying to save on the professional fee for an architect may be a false economy when this is such a small part of the overall cost of building.

THIS ALL SOUNDS GOOD. BUT WHAT NEXT?

Just give us a call (059 8640013) or check out our page ‘Where to Start’.

Updated 08/06/2022

Construction Costs | mcareavey-construct

One of the most frequent questions I get asked is ‘’What is the cost per square foot to build a new house’’. There is no definitive answer to this.

I will outline below what the average cost is and what effects the costs involved in construction.

Average Cost

So, first off what is the ‘average’ cost per sqft to build a house in Ireland. Building costs normally range between €120 to €180 euro per sqft for builders’ finish. They can be more, and they can be less depending on what part of the country you live.

A large straightforward georgian design with a standard spec is generally in the lower range (>3500sqft) and a smaller contemporary design with high spec is generally in the higher range (<1500sqft).

I normally build to builders’ finish. This is the main elements of the house constructed with the final finishes left for the client to complete.

Builders’ finish does not include Kitchen, Utility, Wardrobes, Tiling, Flooring, Painting etc. Externally, builders’ finish does not include driveway finishes such as tarmac, driveway drainage, kerbs, site shaping, spreading of topsoil, lawns, planting, entrance walls, gates, patios, retaining walls, external painting etc.

A rule of thumb is that it costs a further 40% extra on top of builders’ finish cost to finish the house internally and externally. 20% for internal finishes and 20% for external finishes.

If for example builders’ finish costs €250,000 allow €50,000 for inside completion and €50,000 for outside completion.

Allow around €20,000 for such items as planning permission fees, engineer for site inspections, signing off stage payments, solicitor fees, council development charges, utility connection charges, connection charge to main sewage if one available etc.

What dictates house build costs

There are three main elements.

-

Design – The simpler you can make the design the cheaper it is to build.

-

Site topography/ ground conditions – Is the site level or sloping. Is the ground good for foundations and sewage percolation?

-

Specification – Do you want a basic roof over your head, or do you want all the bells and whistles?

Item 1 – Design – The simpler you can make the design the cheaper it is to build.

This is relatively straight forward. The more complex you make something the more expensive it is to build.

Examples are complex shapes, flat roofs, balconies, corner windows, apex windows, bay windows, acres of glass, dormer windows, loads of lead valleys and trays, natural stone facing, vaulted ceilings, sliding doors, structural steelwork, zinc or cedar cladding etc

All these things require additional materials and labour so therefore increase the cost.

Item 2 – Site topography / ground conditions – Is the site level or sloping. Is the ground good for foundations and sewage percolation?

Sloping sites are more expensive to build on due to increased excavation costs to level up the site, stepped foundations, retaining walls to hold up high banks, possibly pumping effluent from your septic tank up to percolation area etc. The flatter your site the cheaper it will be.

Ground Conditions – Is the ground soft or hard, is there rock, is there clay etc. If the ground isn’t suitable for the cheapest form of foundations to support your house (i.e., strip footings), you might require a raft foundation. This is basically a big slab of concrete and steel that goes under the full floor area of your new home. It spreads the weight over a greater surface area therefore making it ‘float’ on top of poor ground.

You might possibly require a raft if you have varying ground conditions. If the ground is all rock or there is part rock and part soil.

You might also require concrete piles and a ring beam if the ground is very poor.

If your site is full of rock it will cost more to remove as it will need an excavator and rock breaker. This is expensive as it is slow. You could spend days or weeks breaking out a rocky site.

Clay can cause problems on a site also. Clay is great for foundations as it has an excellent bearing capacity but has very bad soakage which can cause flooding, ponding or high-water table if the site is fairly flat. It also causes problems for the percolation area as your effluent from the septic tank will not filter through the ground fast enough causing ponding on the surface. In these cases, you may need a soil or sand polishing filter. These are more expensive to construct than a standard percolation area.

Does your site need a standard septic tank or a biocycle unit to process the sewage from your new home? A septic tank is basically a tank that separates the solids from the liquids.

Item 3 – Specification – Do you want a basic roof over your head, or do you want all the bells and whistles?

Things like triple glazing rather than double, aluminium clad windows over PVC, precast concrete first floor slabs, concrete stairs, natural slate roof over a standard fibre cement slate, MHRV (mechanical heat recovery ventilation) over natural ventilation, high airtightness, thicker insulation, loads of plugs and spotlights, Smart Home wiring, Oak rather than painted timber, high end kitchen etc. You get the picture.

We all like looking at Instagram, Facebook, Pinterest etc for ideas but be aware alot of these houses and finishes are on the higher end of the scale.

Economies of Scale

There is also a thing called ‘Economies of scale’. Put simply a large house is cheaper per square foot to build than a smaller house.

I will give an example. Say we have two identical sites. One person builds a 2000sqft 4-bedroom bungalow and the other builds a 4000sqft 4-bedroom two storey. The following costs are similar between both.

-

Management Costs – If both houses have similar spec, straight forward design, and require the same number of subcontractors there won’t be a massive difference in managing its construction. It certainly will not be double the cost.

-

Site excavation – The bungalow has the same footprint as the two storey, so it’s as easy on both houses to get the site level.

-

Sewage disposal. – The septic tank and percolation area will be the same as they both have 4 bedrooms. The amount of drainage pipes, gullies, manholes around the house again will be similar.

-

Driveway – Excavating and stoning the driveway around the house is the same for both.

-

Roof – The cost of roofing both should be similar as both have a roof plan area of 2000sqft.

-

Concrete Footpaths to perimeter – The perimeter measurement will be similar.

-

Electrical – The 4000sqft house will be slightly more expensive to wire but it certainly will not be double the cost of the 2000sqft bungalow if there are a similar amount of rooms.

-

Foundations – Both will be similar. The 4000 sqft house will even be a fraction cheaper as it will have less internal walls downstairs as its rooms are spread over two floors.

-

Utilities – Utility Connection charges will be similar for both.

Say for example all these costs came to €100,000. That’s €50 euro per sqft for the 2000sqft bungalow but only €25 per sqft for the 4000sqft 2 storey. Some costs stay the same or similar even if you double the size of the house.

Changes/Extras

Another item that can hike the price up are changes and extras during construction. I can’t stress enough how important is it to finalise your construction drawings and specification before the builder breaks ground.

If you’re someone who can’t visualise the build, consider a 3D model or 3D visualisation. You might think this is unnecessary, but it will cost a lot less than changes down the line during construction.

There are always going to be small changes during construction but try not to move walls or put in windows or doors after the wall has been constructed for example. Mistakes like these can be costly. If you have to make changes give the builder as much notice as possible. There might be little or no cost implications for minor changes if they are highlighted early enough.

Set a realistic budget and expectations.

The key is setting a realistic budget but also have your expectations in line with that budget.

The house design and specification can be adjusted if you’re at pre-planning stage to come within budget. If full planning has been granted only the specification can be adjusted to come within budget.

It’s imperative you know your budget at pre-planning stage as you can only cut the specification so far. You’ll never bring an expensive design down to a tight budget no matter how much you cut the specification.

Hopefully my explanation will give you an idea of what your house will cost and what you can expect for your money.

Can You Build a House for €150K in Ireland?

Wondering if you can build a house for €150K in Ireland? The last two years have seen construction cost increases that you’ll definitely need to consider when planning your budget. But that doesn’t mean it’s not doable.

________________________________

The question of can you build a house in Ireland for €150K is a tricky one. Not because building your own home cheaply is a difficulty (which, of course, it is). But because while there are always variables to consider when costing an own build, the extraordinary circumstances of the last couple of years have greatly pushed up construction prices.

A current lack of tradespeople to meet demand along with scarcity and supply problems of particular building materials are two of the major problems people hoping to build their own homes will face next year.

Does that mean that building a home for €150K is a pipedream? Not exactly. What it does mean is that if you’re working within the constraints of a very tight budget, then you’ll need to be both very disciplined and a little creative with the options available to you. And if you stick by the four basic rules below, you should be able to pull it off.

Rule #1: Outline the (Pre-Build) Outlays

Dreaming of how you’ll decorate your home may be your number 1 pastime right now. But before you even get to comparing curtain swatches for the kitchen, you’ll need to figure out your pre-build outlays.

These are the fixed costs and calculated fees that are typically forked out before the first brick is laid. Figuring out what they are will give you a realistic idea of how much of your €150k you have to spend on the actual construction (and, of course, the curtains!)

RELATED: 8 Savvy Savings Tips for First-Time Buyers

Fixed costs

We’re talking everything from stamp duty and permits to land registration and insurance.

Land registration fees are calculated based on the value of the land.

If you’ve managed to snag a plot for €50,000 (or less), a fee of €400 will apply.

You’ll also have to stump up for land registry mortgage fees (€175), and Commissioner of Oaths fees (€44).

Stamp duty applies to all residential properties, including sites with agreement to build. The rate is 1% if the property value is up to €1,000,000.

If you’re seeking planning permission there’s more to cough up, starting with the fee for an application to build a house, which is currently €65. Be aware that there are three types of permissions – full permission, outline permission and permission subsequent to outline permission.

If you apply firstly for outline permission to check that the planning authority agrees on principle to your building dreams, you’ll need to provide detailed drawings from your architect and wait for consequent permission before you proceed. All of this can bite into your budget so make sure you’re prepared for that too.

RELATED: Taxes You Need to Consider When Buying a Home in Ireland

Top Tip

To really dot your i’s and cross your t’s in your ‘fixed costs’, add in the cost of selling your existing home.

Estate agents put this at approximately 1.5 – 4.5 % of the value of the property. If you’re not selling but renting, then add in the amount of rent you’ll pay out while you’re constructing your new dream digs.

These are the costs that start to bite you mid-build.

Approximate costs: Including registrations, insurance, planning permission and six months rent (or the cost of selling your current home which we’ve generalised at 2.5% of the current average of a semi-detached house across the country, which according to the Real Estate Alliance (REA) is €264,056) = €7,400

- Fees

This includes all fees due to your lender, solicitor, structural engineer, architectural designer, and local authority.

RELATED: Top Tips for Getting A House Surveyed

Solicitors fees can range anywhere from €700 (excluding VAT) and upwards.

Architectural fees for a full project management service can vary as much as 7-14% of construction costs.

Considering that construction costs tend to amount to between 40-60% of the full cost of building a house, and, as we’ve already stated, those costs have sky-rocketed over the last while, it’s a lot to pay out on a tight budget. It does mean you have someone overseeing the entire build and keeping an eye on the purse strings to boot.

So, shop around. Check with the Royal Institute of Architects of Ireland (RIAI) or this article here, to find the right architect to suit your needs – and your budget.

Top Tip

When looking to engage an architect, meet with at least three contenders and in your discussions with them, make them aware you want to keep costs low and mid-build changes to a minimum.

Approximate costs: €15,000

- Infrastructure Charges & Council Levies

Infrastructure charges include connection to mains water, electricity, and sewerage, alongside any other crucial connections like Wi-Fi or road improvements, that aren’t already in place and will be charged as council levies.

Depending on where you’re building, and whether it’s a rural or urban area, costs here can hike up from a manageable €2,500 to a hefty €8,000 and more!

Approximate costs: €5,000.

- Contingency Costs

Always include a contingency of at least 5% in case any other unforeseen costs start chomping away on your budget.

Approximate costs: €1,575 (worked out 5% of all the above costs).

Rule #2: Build Small

This is just common sense, really. After all, the bigger the house the more bricks, beams, blocks, flooring, tiles, etc., are needed. All of which will put a big dent in an already tight budget.

But don’t worry. Building small doesn’t have to mean shed-size. Ireland’s average dwelling floor space is 81m² (872 sq. feet). So, even if you decide on a reasonably budgeted self-build of 100m² you’re still topping the standard home size.

Before we look at breaking down the typical costs, it’s important to note that when we talk about construction costs in terms of square footage we’re generally referring to complete cost. That means labour, materials, builders’ overheads and their profit are all in the mix – But therein lies the variables. If you want contemporary features rather than a standard design, or, say, underfloor heating or hardwood floors, all of that will affect the overall costs.

Also, because of recent work stoppages and lockdowns, there are shortages in materials such as timber and steel, and that also has a big effect on current costs.

However, something to keep in mind is that of the largest fixed costs in constructing a house, the groundworks, foundations, and roofing are the ones with the heaviest price tags. But the specification and cost for a set foundation size and roof layout will not vary that much whether the design is single or double-storey. So by building up instead of out, you’ll get more space for your buck.

How to Work Out Approximate Construction Costs

The average construction cost to build a home at the moment is around €100 – €150 per square foot. So, the median labour cost on a 100 m2 (1,076 square foot) home will come in at around €134,500 per sq. ft.

This relates to what is called “builders finish” and takes in only the general construction elements of the house and not the internal finishes.

However, this does not give you a huge amount of wiggle room within your €150,000 budget. So, you either need to rethink the size of your home and go for smaller square footage or do your homework in terms of finding a good builder who’s not going to charge you more than the lower rate.

Additionally, location may play a part in whether you can shave some cents off the bill or not. According to the Society of Chartered Surveyors Ireland, houses being built outside of Dublin tend to incur lower labour costs.

That said, if your site is off the beaten track, you may find yourself stumping up for transport to get materials and builders to your site so that the money you save on labour rates is paid out anyway in transport costs.

Approximate Builder’s Finish Costs: €112,980 (incld. €5,380 contingency at 5%)

Rule #3: Stay Simple

The more complex your design, the more costly your home. This is because outlays for materials, and not just labour, are likely to increase.

So back away from the bay windows-in-every-downstairs-room-idea and think twice about living in a tree-house! (We know it’s been your dream since childhood, but…)

Think of simple but still stylish classical architecture designs like the square Georgian shape. Avoid oddly angled walls, internally and externally. Really think through your flooring as this can be one of the biggest material costs.

How to Work Out Approximate Interior Finish Costs

Interior finishes are typically priced at around 20% of the builder’s finish. These finishes include all your further home needs such as built-in kitchen, tiling, flooring, painting and utilities (i.e. plumbing and light fixtures).

Think twice about bringing in specialist craftspeople for specific and complex building work too as you’ll be adding an extra few thousand onto the bill.

Approximate Material Costs: €21,520 (incld. €1,120 contingency at 5%)

Rule #4: Be Sensible

Seeing your dream house taking shape can accelerate your ambitions.

It’s often at the installing stage that you start to convince yourself that an extra euro or 2,000 won’t matter much as long as you’re keeping to a ballpark figure of your original budget.

But #realtalk: Overspending in one area means cutting costs in another. Or risking the chance of having to halt work mid-build because you’ve run out of the readies.

Areas such as tiling, fitted kitchens, bathroom suites, cabinets, wardrobes, and various appliances, can make a difference of thousands if you decide to opt for uber- quality.

RELATED: 7 Simple Home Improvements You Can Do for Less than €100

For example, heating systems come in all shapes and sizes nowadays. But a state-of-the-art heating system complete with underfloor heating, high-end boiler and fancy controls can easily set you back €5,000- €7,000 (unfitted). While standard radiators and condensing boilers may come in at under half that price.

We’re not suggesting you skimp on quality. But invest in what’s best for you – and your budget.

Additional Ways to Cut Down on Costs

- DIY it Where Possible

Taking on some of the tasks such as plastering, painting, decorating and tiling can make big savings on your self build.

But only do it if you’ve got time – and experience. In other words, be realistic about what you can do and can’t do. And communicate with the builder so they know when you’re on-site and what they can knock off their to-do list.

Potential Savings: Daily rates for professional labourers differ depending on trade, but typically land around €150-1€80 per day. Depending on how much graft you’re willing to do and which area you’re able to tackle, you could make a savings of €500 – €3,000.

- Project Managing if you have the Time, Skills, and Moxie

Project managing your build will enable you to save thousands – if you do it right.

It’s a massive undertaking and one not to be taken on without really understanding the pros and cons.

As project manager you’ll be expected to do everything including managing the day-to-day details of the site, hiring and scheduling trade, sourcing and managing materials, and keeping everything on time and within budget.

If you don’t want to hire a main contractor as project manager, but don’t want to take on the bulk of the work yourself either, you could think about taking on some of the tasks and then talk to your architect and builder about what they can do on your behalf.

Potential Savings: €3,000 – €10,000

- Sourcing (Bargain) Materials

Bargains can be found for fixtures and fittings, such as simple lighting, PVC windows and fitted kitchens. If your designer or builder sources fixtures or appliances that you feel are too expensive, do it yourself and see if you can find something cheaper.

Always talk to them first about sourcing materials. Truth is, they may be able to get better bargains on bulk items – e.g. bricks, blocks and types of timber.

But if you have the time and the tenacity, you could likely track down cheaper, but still quality-based, baths, showers, boilers, kitchen cabinets, etc.

RELATED: Six Interior Design Trends to Watch in 2020

Check out smaller local businesses for possible deals, and mix and match with basic and luxury fittings for a high-end look at high street prices.

Potential Savings: 21,000 – €12,000

The Final Figure

Our approximate pre-build and construction costs, along with a median €14,000 saving due to DIYing it, brings the total to €149,460.

Of course, the cost of any self-build depends on such unique variables as the ideas and tastes of those building the house.

Nonetheless, our figure rounded off €149,500 does show that with some forethought and focused planning it is possible to build the home of your dreams with a budget of €150k …and still have €500 left for curtains for all the house – not just the kitchen!

New Build House Cost Survey

A while ago we carried out a new build house cost survey with some tradesmen on Tradesmen.

Frank from Dublin: Say €2000 to €2500 /m2 is a realistic amount to be aiming for. This could rise to €2800 /m2 and above depending on the level of finishes (hardwood timber flooring / tiles/ sanitary fittings & unitary/ electrical fixtures & fittings) kitchen type / mechanical installations (solar; air to water; HRV) BER rating being sought etc.

For a new build we recommend engaging a QS to do a bill of quantities or alternatively a schedule of works for pricing so one can compare like for like tenders received and reduce costly arguments further into the building process.

Anthony from Dublin: 2000 euro a square metre. Tip: The customers should take a look at previous work the builder has done

Pat from Dublin: 3800 a square metre for new build 3950 a square metres for extension 4000 for a square metre for renovation work

Daniel from Westmeath: Roughly €250,000

Ciaran from Wexford: Currently for this size of property would be in the region of 2000/ 2400 per square metre for standard block cavity construction to current regs.

Arthur from Kildare: Rough cost for new build would be 2500 ex vat per m2

Willie from Longford: I’m building house’s at roughly 115-120 sq foot at the moment depending on the spec of the house ? windows,stone facing etc that’s just a builders finish they’ll have 20,000 to spend on also on engineers fees, solicitors, ESB,Water connections not to mention the cost of the site my advice to anyone building is if there not sure about the cost of building bring the drawings to a QS to revise they’ll be up to date with the Rates

Tom from Kildare: 200000. Tips: Have drawing.. Have the money in place… Starting work in good weather.

Sean from Galway: 150sq metre house would cost around 250,000 at todays costs. the builder will need a detailed specification in order to be able to price the job accurately. Get the builder to provide references from previous houses that he built. Stage payments are the standard method of payment for a new build.

John from Kilkenny: Budget build start at 1500 per metre 2. I’ve just finished a home that was 167m2 @ 2,700.00 per m2. Tips : People need to engage with a good architect and relay the budget to the architect as I’ve priced more job for people that have got planning and realised they can’t afford the cost to build it ! Get a QS before you put it out to tender so you know how much the build should cost and that you haven’t got guys in there van pricing it on the back of a cigarette box, because it happens ! If someone 10 k or more cheaper than the other contractors there is a reason !

Sean from Cork: A rough estimate for 1600sq foot dormer type house would be € 220000 a lot depends on the spec the client requires I would be including a air to water unit for this price but not a heat recovery system.

Ronan from Louth: The cost would be from €225000 to €300000 plus vat depending on the spec. My advice would be not to make changes for no reason after work has started.

James from Dublin: Guide price on new build €200,000- €220,000 , this is pending as there is many areas and hidden extra as costs varies in different counties In Ireland, also access to site etc. Client should have a good architect and stage payments put in place. Be careful when getting prices as a builder finish does not include painting , fire places kitchen etc , these are all extra , so when getting prices on new build make sure the builder clarify what he is doing for the client so there is no misunderstanding.

—————-

With the exceptional price inflation in materials this year, prices are out of date almost as soon as they have been committed to paper and builders are finding it increasingly difficult to stand over tender prices for extended periods.

I hope this helps some of you who are planning new build sometime in the future and if you decide to go ahead with it be sure to post your new build job here and get up to 4 quotes from rated tradesmen.

Cheers

Oliver Dempsey

Tradesmen.ie

12th December 2021

Here are some tips to consider when hiring a tradesman:-

1. Ask for phone numbers of references so that you can check them out

2. Check insurance of the tradesman where insurance is required

3. Hire a suitably qualified architect, building surveyor or building engineer if the job is anything to do with a new build, building renovation or extension

4. Agree on some sort of stage payments for the job. Remember that full payment should not be made until the job is complete and has been inspected by you, and if necessary by a certifier.

Here are some other articles that you might be interested in below:-

House Extensions – 12 Tips on Extending your Home

Do I need planning permission?

Certifying my building or renovation

Construction Contracts, why are they needed?

Attic Conversion Prices

Top 10 Tips to Building a Home

Related posts:

This entry was posted in Price Comparisons and tagged new build, new build cost, New Build House Cost, new build prices. Bookmark the permalink.

Rising materials costs causing building prices to soar

Published:

Last updated:

A crisis is building in Ireland’s construction sector – a combination of soaring materials costs, scarcity of product and a shortage of manpower.

In the two years between June 2019 and June 2021, wood, steel and insulation have rocketed in cost – as have pipes, electric cable – in fact every material necessary in construction.

Add to this the supply chain issues resulting from the HGV driver shortage affecting many countries worldwide, and the recent rapid surge in fuel prices, and it becomes clear that there is not going to be a reversal of the escalation any time soon.

“I don’t understand why this is not headlines every day,” says one builder locally, summing up pithily how serious the crisis is.

In just 12 months, the cost of building a house has risen by around a third, according to consultant engineer John Madden of John Madden and Associates.

John Madden.

Photo by

Eilis Ryan

“Over the last year – and particularly the last six to eight months – it’s gone crazy,” he says.

“The building costs in Ireland for an ordinary standard one-off house out the country would come in at about €130 to €150 per square foot, for a builder, and that is just a builder’s finish.

“But what we’re seeing now is that it’s gone absolutely through the roof.

As an example, he cites the cost of A393 mesh, the standard mesh used in concrete foundations: “A year ago it was €45 a sheet. And the sheet is the same size as a sheet of plywood. It is now €105. It went up to €75.

“Steel has gone through the roof and the next thing then is timber and PVC piping. If you saw what you would buy a year ago – in terms of timber – and what price it is now! That’s gone crazy. There is a shortage there. And then the other one is PVC piping, as in your ordinary Wavin pipe that you put in the ground: it has trebled in price – and the same with the fittings, it is difficult to get them.”

Damien Clear of Damien Clear Construction, whose company is involved in both the planning and design, doesn’t mince his words: “It is frightening: we are not sure where it is going to end. There is a slowdown in the increases, but they still are going on.

Damien Clear, of Damien Clear Construction.

He also cites the rocketing price of A393 mesh as an example: “I know someone who had to pay €130 for it,” he says.

“With timber, a 4×2 was €7: you won’t get it much cheaper than €13 now; a 9×2 was €14, it’s over €33 now; a bag of skim was €10 but you wouldn’t get it for €15 now.”

Sources tell him that concrete is expected to rise by between 5pc and 10pc in January.

One builder involved in commercial construction says the upward movement in prices became noticeable at the end of last year, but began gathering pace at the start of this year.

“There’s no control at all on costs for steel, timber, plasterboard, metal studs, anything like that. Also copper, electric cabling,” he says. “Everything has gone through the roof. PVC has gone up as well because of the oil thing and because of the scarcity of it as well.”

He has never seen prices rise at this sort of rate before.

“Materials-wise it’s definitely 20 to 25pc dearer than a year ago, and wages have gone up as well. So I would say it’s about 35pc dearer for a job.”

Engaged in the construction of private houses, as well as renovations and extensions, Noel McDonnell of McDonnell Carpentry and Construction, Ballymore, says it’s not just that materials are expensive: “The scarcity of materials is [also] the issue: bar you are in good standing with your supplier and keeping the bills paid, it is hard to get supplies.”

Noel McDonnell of McDonnell Carpentry and Construction, Ballymore.

It’s tricky for tradespeople who have agreed a price with clients; but despite the increased materials costs, Noel wouldn’t be happy to go back and tell them it will cost more than the price agreed. “You are only as good as your word,” he says. “You agree the price at the beginning and then you try and get through the work as quickly as you can.”

While labour costs have risen, that rise has been dwarfed by the rocketing cost of practically everything on the long list of items that go into any building: “It’s all materials that are driving the price of house building.

Insulation is “nearly gone unaffordable”; timber alone has jumped “five or six times” this year.

“And it’s in short supply. Everybody’s trying to buy up as much as they can.”

Huge quantities of timber are required in house building: “The biggest part of the timber use in the house is the roof, but then you have the internal finishes.”

Noel’s sympathies in this overheating marketplace are with young people who are building their first houses: “They’re the ones who are going to end up bearing all the costs,” he says, pointing out that while a builder will try and look after people the best they can and do good work, at the end of the day, they can’t afford to lose money at the job.

A further dimension to the rocketing costs crisis is the lack of certainty and the lack of stability it is introducing to the construction sector – something affecting not just the couple having a one-off house or a home extension, but developers of estates; local authorities or housing associations building homes; and commercial projects.

The result is that builders giving quotations are now only holding their tender prices for two weeks: “They used to hold their tenders for 90 days, and they are now building in clauses saying if materials go up, they will be passing on the costs – and that leaves a lot of uncertainty.”

John Madden knows of a 250-house development on the east coast currently on its fourth redesign because of costs. They started with block-built houses; shifted to timber frame; shifted again to concrete panels, and are now looking to change again, this time to ICF (insulated concrete formwork) – all in a bid to keep costs down as prices rise.

Damien Clear says if there is a positive, it is that it is encouraging contractor to look at other materials: “I think it takes a crisis like this for people to break the mould and start to look outwards for new building technologies such as ICF.

“It’s a little bit more expensive in the actual application but it saves a huge amount of time, and by virtue of that, you save a huge amount of risk, you are saving on labour, you are saving on air tightness, you are improving the product quality, in that it’s a fully sealed unit.

Those eight weeks are becoming crucial in an environment where material costs are rising weekly or fortnightly.

‘Perfect storm’

Those in the sector agree on the factors that have led to the crisis. “A perfect storm” is how John Madden describes the arrival of the hike in materials costs at the same time as the labour shortage.

Brexit has been an issue, as has been the general supply-chain hold-ups affecting many countries. Along with that, Covid lockdowns in this country and elsewhere would have affected production and processing of materials.

Some of the reason for the hike in wood costs is “home grown”, Noel McDonnell explains: “The problem is the government are not giving felling licences,” he says.

Demand from the public is also an issue: “Builders are just inundated with work because everyone has a few bucks saved over the Covid period,” John Madden reckons.

“Another thing, I think, is during Covid there was a lot of work still going on, bits and pieces, so any surplus materials that were there were used up, and now we’re back into production but it’s going to take a while for that to get figured out.”

John has already gone public over his concern over how Ireland’s retrofit targets are to be met in light of the shortage of construction professionals and the long lead-in times for those in training through apprenticeships.

“A lot of the foreign nationals who are great in the building trade have gone back home, and they are not as quick to come back. So there is a massive shortage of labour.”

“People are now putting on hold building houses or extensions even though they have the money because the prices are gone crazy,” John adds – but at the same time, those who do want to press ahead with projects are finding it difficult to get anyone who is in a position to take on the job.

He is of the view they may well have a long wait ahead.

Future

As to where things are headed, Damien is already seeing a scaling-down in the size of houses to save on costs.

“We’d love to see a full reduction in prices but I’m 20 years at the game and I have never ever seen prices come down significantly compared to what they have gone up. So if we’re looking at numbers of 20pc to 30pc even 60pc or, in extreme cases even 300pc, of an increase in material prices, the best you probably could hope for will be somewhere in the middle, that it would reset somewhere in the middle. But that hasn’t happened yet, and everyone is kind of looking at the new year to see if that will happen.”

HOW MUCH DOES IT COST TO BUILD A HOUSE IN NORTHERN IRELAND IN 2021?

This is great news for many people who have been saving up to place a deposit on their first home. However, what about those who are planning to build a house? The question is, how much does it cost to build a house in Northern Ireland in 2021? Housebuilding is expected to slightly drop in the coming year, however the good news is that it will prove slightly cheaper.

Costs

As with any year you choose to build, the first thing to consider are the costs that you are going to incur. The costs are dependent on a range of factors (which we will look at in this blog) and it is important you not only consider each factor carefully, but also have a small extra bit of budget set aside for contingency plans.

When building a home, it is not just the house that you need to consider, but everything around it. If you were buying a home, you would look into the neighbourhood, see what the surrounding environment is like and if you’ll fit in there. Similar decisions need to be made for building a house, but more practical yet – you’ll also need to purchase the land! You cannot go building your home anywhere you please, there is a process of purchasing land and acquiring permission to build there.

Size of Home

The size of the home you are planning on building will have a big impact on price. As it stands, building a house in Northern Ireland can cost anywhere between £60 to £100/sqft, depending on the specifications of the house. The size of your house is measured in square metres and builders will provide a quote based on size, design plan, and also the number of stories in your house.

Design

Design plays a large factor in house building. Everyone knows exactly what their dream home will look like and even though an architect will plan and design your home, it is important you give your input as undoubtedly one of the reasons you are choosing to build instead of buy is because you have very specific ideas on what you would like your house to look like. Whether you have a simple and traditional plan in mind, or something a little more complex and modern – these ideas should be discussed at a very early stage so you can understand the cost implications and how this can be factored into your budget.

When hiring, you should look into a few different options before you choose your architect, as you want to make sure you choose someone that has design experience similar to what you are looking for. The same goes for any hires you make during your self-build project. You should be hiring people that can clearly envision your house just as you can. This means also having builders that can work well to the specifications they are given for both inside and outside the home and can complete the project on time without it running over budget.

Project Manager

To ensure your project stays on its approved timeline, you may choose to hire a project manager. This is not an essential part of building your home, and many people choose to save money and oversee the project themselves.

Finally, once you have settled on an area, a design, and those who are helping you build – you will need the materials to do so. This includes everything from timber to brick, to mortar, and the glass for the windows. There is a lot to consider, and as with any home project, there are lots of different materials and brands to choose from. Some you may be picky about and should choose high quality, and some you can choose a cheaper material to save a little money. You should understand the pros and cons of each type of construction material as it will greatly help you in making a decision on which is best to use. If you have any queries, why not call into your local Haldane Fisher branch and speak to one of our experts?

Haldane Fisher: Self Build

Our Haldane Fisher website show a wide range of building materials that we can provide for your self-build; however, our best tool is our handy self-build cost calculator.

December 15, 2020 | Categories: Blog

Search engine powered by ElasticSuite

New buildings in Ireland – catalog of new buildings in Ireland with current prices

G

New buildings

New buildings

Resellers

Commercial property

In any city

Country

All countries

Georgia

Australia

Austria

Azerbaijan

Albania

Andorra

Armenia

Belarus

Belize

Belgium

Bulgaria

Bosnia and Herzegovina

Great Britain

Hungary

Germany

Greece

Denmark

Egypt

Israel

India

Indonesia

Ireland

Spain

Italy

Kazakhstan

Canada

Cyprus

Kyrgyzstan

Latvia

Lithuania

Luxembourg

Malawi

Malaysia

Malta

Mexico

Moldova

Monaco

Netherlands

New Zealand

Norway

UAE

Poland

Portugal

Russia

Romania

USA

North Macedonia

Serbia

Singapore

Slovakia

Slovenia

Thailand

Turkey

Ukraine

Finland

France

Croatia

Montenegro

Czech

Switzerland

Sweden

Estonia

City

AnyDublinWicklow

Area

Metro station

Object type

Residential building

Apart-hotel

Townhaus

House

Villa

9000Ol000 Warehouse

Production

Free use

Destination

Cafe/Restaurant

Bakery

Beauty Salon

Pharmacy

Bank

Medical Center

9000 9000 9000 9000

Price

Price, $/m 2

Price, $

Installment plan

Hot deals

Cryptocurrency payment

Crowdfunding

Cashback available

More filters

Square, m 2

Square, m 2

floors

distance to the sea, m

Number of bedrooms

Vyustodia12345 and more than

Number of bedrooms

Vytrostudiy12345 and more0003

AnyPitch Completed 30%Frame erectedFacade completedFully completed

Condition

AnyBlack frameWhite frame Turnkey

Condition

Any

black frame

white frame

New renovation

Requires repair

Near the hospital

Fitness room

Service

Parking

Underground parking

Concierge

Basin

Spa

Safety

Security 9000 9000 Secectedly

Price

Date added

Popularity

Found objects: 22

Dun Si

From $3400

/ m 2

ID: 20692 | 2 floors

Skylark

From $3450

/ m 2

ID: 20690 | 2 floors

Cherrywood

From $4200

/ m 2

ID: 20688 | 12 floors

glass bottle

From $4200

/ m 2

ID: 20686 | 25 floors

Waterfront South Central

From $4200

/ m 2

ID: 20685 | 45 floors

Spencer Place Residential

From $4200

/ m 2

ID: 20684 | 7 floors

Rathborne Boulevard

From $3400

/ m 2

ID: 20683 | 2 floors

Kilbride

From $3150

/ m 2

ID: 20682 | 2 floors

Arranmore

From 2850$

/ m 2

ID: 20680 | 4 floors

Belgard Gardens

From $3600

/ m 2

ID: 20679 | 7 floors

Kylemore

From $3200

/ m 2

ID: 20677 | 4 floors

Mount Argus

From $4600

/ m 2

ID: 20673 | 4 floors

Brennanstown Road

From $3750

/ m 2

ID: 20671 | 8 floors

Rennie Place

From $3650

/ m 2

ID: 20665 | 3 floors

Claremont

From 3500$

/ m 2

ID: 20661 | 5 floors

foxlands

From $3650

/ m 2

ID: 20658 | 6 floors

Ropemaker Place

From $4300

/ m 2

ID: 20653 | 5 floors

Grand Canal Harbor

From 3500$

/ m 2

ID: 20652 | 13 floors

Green Acre Grange

From $4600

/ m 2

ID: 20651 | 6 floors

walled garden

From $3600

/ m 2

ID: 20650 | 6 floors

One Lime Street

From $4200

/ m 2

ID: 20649 | 6 floors

St.

From $4500

/ m 2

ID: 20648 | 5 floors

%name%

%name%

New buildings in Irish cities

Dublin

Wicklow

Is it possible to buy a house in Ireland remotely?

Can citizens of other countries buy an apartment in a new building in Ireland?

Is there an installment plan for buying an apartment in a new building in Ireland?

How many new buildings from the developer in Ireland?

What is the minimum price per sq. m. in a new building in Ireland?

What are the most popular new developments in Ireland?

What are the popular cities in Ireland for buying apartments in a new building?

New buildings Dublin – catalog of new buildings in Dublin with current prices

G

New buildings

New buildings

Resellers

Commercial property

In any city

Country

All countries

Georgia

Australia

Austria

Azerbaijan

Albania

Andorra

Armenia

Belarus

Belize

Belgium

Bulgaria

Bosnia and Herzegovina

Great Britain

Hungary

Germany

Greece

Denmark

Egypt

Israel

India

Indonesia

Ireland

Spain

Italy

Kazakhstan

Canada

Cyprus

Kyrgyzstan

Latvia

Lithuania

Luxembourg

Malawi

Malaysia

Malta

Mexico

Moldova

Monaco

Netherlands

New Zealand

Norway

UAE

Poland

Portugal

Russia

Romania

USA

North Macedonia

Serbia

Singapore

Slovakia

Slovenia

Thailand

Turkey

Ukraine

Finland

France

Croatia

Montenegro

Czech

Switzerland

Sweden

Estonia

City

AnyDublinWicklow

Area

Metro station

Object type

Residential building

Apart-hotel

Townhaus

House

Villa

9000Ol000 Warehouse

Production

Free use

Destination

Cafe/Restaurant

Bakery

Beauty Salon

Pharmacy

Bank

Medical Center

9000 9000 9000 9000

Price

Price, $/m 2

Price, $

Installment plan

Hot deals

Cryptocurrency payment

Crowdfunding

Cashback available

More filters

Square, m 2

Square, m 2

floors

distance to the sea, m

Number of bedrooms

Vyustodia12345 and more than

Number of bedrooms

Vytrostudiy12345 and more0003

AnyPitch Completed 30%Frame erectedFacade completedFully completed

Condition

AnyBlack frameWhite frame Turnkey

Condition

Any

black frame

white frame

New renovation

Requires repair

Near the hospital

Fitness room

Service

Parking

Underground parking

Concierge

Basin

Spa

Safety

Security 9000 9000 Secectedly

Price

Date added

Popularity

Found objects: 21

Dun Si

From $3400

/ m 2

ID: 20692 | 2 floors

Skylark

From $3450

/ m 2

ID: 20690 | 2 floors

Cherrywood

From $4200

/ m 2

ID: 20688 | 12 floors

glass bottle

From $4200

/ m 2

ID: 20686 | 25 floors

Waterfront South Central

From $4200

/ m 2

ID: 20685 | 45 floors

Spencer Place Residential

From $4200

/ m 2

ID: 20684 | 7 floors

Rathborne Boulevard

From $3400

/ m 2

ID: 20683 | 2 floors

Arranmore

From $2850

/ m 2

ID: 20680 | 4 floors

Belgard Gardens

From $3600

/ m 2

ID: 20679 | 7 floors

Kylemore

From $3200

/ m 2

ID: 20677 | 4 floors

Mount Argus

From $4600

/ m 2

ID: 20673 | 4 floors

Brennanstown Road

From $3750

/ m 2

ID: 20671 | 8 floors

Rennie Place

From $3650

/ m 2

ID: 20665 | 3 floors

Claremont

From 3500$

/ m 2

ID: 20661 | 5 floors

foxlands

From $3650

/ m 2

ID: 20658 | 6 floors

Ropemaker Place

From $4300

/ m 2

ID: 20653 | 5 floors

Grand Canal Harbor

From 3500$

/ m 2

ID: 20652 | 13 floors

Green Acre Grange

From $4600

/ m 2

ID: 20651 | 6 floors

walled garden

From $3600

/ m 2

ID: 20650 | 6 floors

One Lime Street

From $4200

/ m 2

ID: 20649 | 6 floors

St.

From $4500

/ m 2

ID: 20648 | 5 floors

%name%

%name%

Services for those who want to buy an apartment in a new building in Dublin

Dublin New Build Auto Tour

See the types of properties in Dublin for yourself. The options are presented from the developer’s sales department. See all types of real estate, make a car tour. Indicate the date of your visit and go to see the apartments in a comfortable car along the indicated route. Read more about the service at the link.

Finding new housing in Dublin

Are you looking for an apartment in Dublin that meets the specified requirements? Entrust the task to an expert. Specialists of the real estate company GEOLN.COM will find new houses that meet the characteristics specified by the buyer. You will receive the completed list by email. More.

Legal support of real estate transactions in Dublin

Do you want to buy an apartment in Dublin without financial risks? Then invite a lawyer to conduct the transaction.

Dublin New Homes Online Tours

Want to see some of your favorite new homes in Dublin but can’t tour in person? A convenient alternative to an individual inspection is an online real estate tour. Modern means of communication are used at the choice of the client, the expert will go through the new houses you have chosen, indicate the distances, the features of the location of the object.

Mortgage for the purchase of housing in a new building in Dublin

Do you want to buy an apartment in a new building, but do not have enough personal funds? Then you will be interested in the service of registration of a mortgage via the Internet. Banking specialists in online mortgages will agree on the terms of the loan without visiting the office. You will find out the available terms, interest rates, repayment scheme.

Transfer to the developer’s sales office in Dublin, Ireland

Are you planning a visit to the chosen house? Coordinate the details via the Internet, clarify your questions, order a free transfer to the sales department. Just specify the necessary parameters, and we will organize the transfer ourselves.

Property tour in Dublin

Property tour from GEOLN.COM is a 100% unique product. You will see objects of interest quickly. Choose a country, combine a tourist trip, vacation with investment. The tour for the buyer is free – after the execution of the contract of sale by the developer, you will be credited with 100% cashback.

Do you want to sell your apartment in Dublin?

Thanks to the GEOLN.COM search engine, this is very easy to do. List real estate online in a couple of clicks and sell! On GEOLN.COM, buyers from all over the world are looking for real estate.

Dublin real estate expert advice

We provide expert advice and comprehensive services to support real estate transactions in Dublin. The purchase will be made with the support of an expert. When ordering an escort service from GEOLN.COM, you get a guarantee of the safety of funds and minimize risks. The investment will be 100% secure. Large selection of housing, a full range of additional services.

Real estate appraisal in new buildings in Dublin

If you want to sell real estate through the GEOLN.COM system, indicate the most reliable, 100% correct characteristics. Photos, prices, other parameters will give buyers complete information about the object. We provide valuation services in Dublin. We name real prices, draw up certificates. Housing after assessment is indicated in the system with a special icon.

Rate the usefulness of the information:

Average score: 4.49 . Voted: 166

Is it possible to buy housing in Dublin remotely?

Can citizens of other countries buy an apartment in a new building in Dublin?

Is there an installment plan for buying an apartment in a new building in Dublin?

How many new buildings from the developer in Dublin?

What is the minimum price per sq. m. in a new building in Dublin?

What are the most popular new developments in Dublin?

Ireland issues tourist visas to Russians. And what about real estate?

Ireland is one of the few European countries that issues short-term visas to Russians. You don’t need a reason to enter – just a tourist destination. Air traffic has also been restored: Aeroflot flies from Moscow to Dublin every week. And in the real estate sector, Ireland surpasses its neighbors in some respects. Here you can still earn up to 10% per annum in hard currency with minimal risk.

Read also: Ireland began issuing short-term visas to Russians

What you should know about Ireland

Ireland is a relatively small country with about 5 million people. However, in terms of economic development, Ireland confidently falls into the top lines of various ratings. Thus, in terms of GDP per capita, the country ranks fifth in the world. For the past six years, Ireland has been the growth leader in the EU. Its GDP increased:

- by 9.1% in 2017,

- by 8.5% in 2018,

- by 5.5% in 2019.

The level of economic development of Ireland is excellently characterized by the ratings from the IMD World Competitiveness Yearbook 2019 report. According to this report, the country is in the top 15 countries with the most innovative economy in the world;

6 in the world in terms of economic freedom;

6 in the world in terms of economic freedom; The last two points require a separate comment. Everyone, of course, has heard about tax preferences in Ireland – thanks to them, the country attracts big business. Low corporate tax rate (12.5%), R&D tax deduction – PwC in 2019 reportyear put Ireland in first place in Europe in terms of ease of calculating and paying business taxes.

The crisis of 2020 has, of course, also affected Ireland, but so far only moderately. According to the country’s Central Statistical Bureau, in the first half of 2020, GDP decreased by 6.7%. But in the third quarter, after the weakening of quarantine measures, an increase of 11.1% was recorded. Despite the newly introduced restrictions in November 2020, the department’s forecast for the whole year is positive – plus 1-2%.

IDA Ireland experts also predict that Ireland will be slightly affected by the pandemic in 2020. The reason is the structure of the country’s economy. For example, 14 of the 15 largest manufacturers of medical equipment and all major pharmaceutical companies in the world have their headquarters here. Ireland ranks seventh in the world in pharmaceutical exports.

The scale of the presence of large international business is easier to assess if you list the well-known transnational corporations whose European headquarters are located in Dublin. Brexit played an important role in the concentration of large international business in Ireland, especially in terms of financial companies and banks.

Top global companies headquartered in Dublin in Europe

|

IT |

Pharmaceuticals |

Finance |

|

Google

Amazon PayPal Sales force HP Microsoft Intel Dell |

Pfizer Allergan Gilead Sciences Leo Pharma Merck Regeneron Mylan Novartis Takeda Shire Jazz Pharma |

Deutsche Bank Allianz State Street J. Bank of America MasterCard BNY Mellon Citibank Barclays HSBC |

Investment in Dublin. Why is it interesting?

But what about real estate? Theoretically, it is clear why it is of interest to investors: the economy is growing, demand is increasing, and then there is the mass arrival of highly paid expats to the country … The market is trying to match.

The pace of construction in Ireland. Source: Central Statistical Office

Due to the fact that the most active growth occurs in the rental housing market, in terms of investment attractiveness, residential income-producing real estate is in first place. Dublin has a chronic housing shortage and this imbalance will persist for a long time to come. If during the period of rapid economic growth in the capital of Ireland, the construction of offices was actively carried out, then the volume of housing construction was much more modest, which only increased the disproportion.

It is already clear that the 2020 pandemic will significantly affect the dynamics of new housing construction. In the second quarter of 2020, most construction projects were frozen, and even an increase in construction activity in the third quarter did not turn the tide – on an annualized basis, there was still a decline in the commissioning of residential properties by almost 14%.

An additional factor influencing the situation in Dublin is population growth. In 2019, 1.38 million people lived in the capital, five years earlier – 100 thousand less.

New housing is being built to a limited extent, especially in the center. Back in 2019, Trinity College Dublin economics professor Ronan Lyons stated in his study that in order to meet demand, about 500 apartments had to be commissioned in Dublin every week (!) for three years. This is completely unrealistic at the moment. For example, in the relatively calm first quarter of 2020 in terms of the pandemic, only 1,658 housing units were commissioned in Dublin.

Real estate trends in Ireland

Price dynamics

Until 2020, according to the Irish Central Bureau of Statistics, real estate prices rose: from 2013 to 2019, prices increased by 56%.

Data on price dynamics for 2020 so far exceed expectations. It is already clear that Dublin property prices have remained at the same level last year (for more details, see The Irish Times article dated January 4, 2021).

Large foreign investors will play an increasingly important role in the profitable real estate market, which began to look closely at the Dublin market even before 2020. Here are just a few examples of transactions involving well-known foreign players.

- Deutsche Bank acquires Westend Retail Park in Dublin for €148 million

- The Heitman group from the USA bought 214 apartments in Dublin for €52 million.

- The German Patrizia Foundation invests €52.5 million in a building in Dublin’s Docklands.

- German company Union Investment buys a newly built office in Dublin for €190 million.

- Swiss Life asset managers decide to invest €27 million in Dublin.

Rates and returns

Economic growth naturally led to a significant increase in rental rates in Dublin. In 2019, the capital of Ireland was among the top 5 European capitals in terms of rental prices (report by Employment Conditions Abroad International (ECA)). Given the lack of housing in the city, especially in the central regions, one should not expect a change in the situation.

According to a Daft.ie report, the average monthly rent in the country is €1,300. Rates are higher in Dublin. For example, renting an apartment with three bedrooms in the suburbs of Dublin will cost €1.7–2.2 thousand, within the city – €1.8–2.6 thousand. But the data on the average rental rates for a one-bedroom apartment in Dublin (source – Central Statistical Office).

Average rent for a one-bedroom apartment in Dublin

If we talk about the profitability of properties, then in Dublin it will vary from 6 to 10%, depending on the type and individual characteristics of the property.

But first things first.

Dublin 9 real estate investment options1061

Option 1. Profitable apartments

Apartments in the center of Dublin in modern residential complexes built in the 2000s.

-

Sergey Kumekov

partner

Spire Capital

-

Rented here by the middle class and expats. The price range for such property is €250,000-350,000. A studio or one- or two-bedroom apartment can bring 6-8% when rented out. For the center of a European capital, this is a high figure.

As a rule, all apartments in the center are rented with high-quality furniture. Therefore, investors should pledge up to €10,000 for its renovation and possible repairs. Such apartments are not vacant for a long time – the tenant stays for several days.

Which area to choose?

Three quarters are considered the most promising.

IFSC (fiscal quarter). Citibank, KPMG, J.P. are based in the area. Morgan, Grant Thornton and State Street. And about 50 largest banks in the world and several large insurance companies. The most popular complexes among tenants are Spencer Dock, Clarion Quay, Spencer House and Custom House Square. Prices for apartments here start from €250 thousand, rent – from €1.6 thousand.

Dublin Financial District Offices

Silicon Docks. The area was formed in the early 2000s as part of the docks reconstruction project. Now it is a local analogue of Silicon Valley. Here are the headquarters of Google, Facebook, Twitter, LinkedIn, Airbnb. It is the employees of large IT companies that are the main tenants here. They choose the residential areas of Longboat Quay, Hanover Quay, The Waterfront and The Waterside. An apartment costs at least €300,000. You can rent it out for €1,700 per month.

Google Office in Silicon Docks

Smithfield & Stoneybatter (legal quarter).

Historic Development in Dublin’s Legal Quarter

But there is another notable type of property in Dublin…

Option 2. Tenement houses Pre 63

Most tenement houses in the center of Dublin belong to the so-called Pre 63 category. These houses, usually built in the first half of the 19th century, were originally intended for a single family of aristocrats. Subsequently, already in the 20th century, they were divided into small apartments.

A typical tenement house in Dublin

In 1963 in Ireland, at the legislative level, regulations were adopted that established the minimum allowable area of apartments. However, these norms did not apply to the already existing housing stock.

-

Sergey Kumekov

partner

Spire Capital

-

Firstly, these buildings are usually located in the very center of the city. Secondly, the prices for renting apartments in them are noticeably lower than in new buildings. You can rent a small studio here for about €1,000 per month, while an apartment in a modern residential complex will cost twice as much. Accordingly, the list of tenants here is wider.

Buying an apartment building allows you to earn up to 9-10%. This figure can be increased by improving housing conditions. Global repairs are not needed: usually it is enough to change plumbing, make light “cosmetics”, install a boiler or wi-fi.

The selection of such proposals requires a scrupulous search and selection, but the potential of a correctly chosen object is huge.

1. Irish law allows for the change of ownership of an apartment building to evict all tenants – for repair work.

2. As in other countries, it is easier to manage an apartment building than separate apartments, especially in different locations.

3. It is less profitable for local residents to buy profitable real estate: they bear the burden of high income tax. As a result, foreign investors, ceteris paribus, receive higher returns.

4. Pay attention to the low tax when transferring ownership of objects (stamp duty). For real estate worth up to €1 million, it is 1%. For comparison, in Berlin, a similar payment is 6% of the price of the object.

-

Sergey Kumekov

partner

Spire Capital

-

It is more profitable to invest through a company. This will optimize taxation, as well as eliminate the risks of the owner. Due to the fact that funds for the purchase of real estate can be provided as a loan to your own company, corporate tax in Ireland will be paid at a minimum amount.

In turn, income from real estate will be distributed in favor of the investor in the form of interest on the loan, which will no longer be taxed in Ireland.

Examples of properties for investment in Dublin

€700,000

Apartment building in Germany

1259 m 2

Germany

Rhineland-Palatinate

Kaiserslautern

Profitable house in the city center

Prestigious central area of the city

Year of construction of the building: 1960

In 2010, the building was completely renovated: a new facade, new windows, roof,

new oil boiler, new oil tanks.

In the building: 3 apartments, 2 terraces, 3 offices, 3 car repair shops, 1…

INDOM

174,000 €

Apartment in Cologne, Germany

57 m th floor of a house built in 1959. In total, the house has 5 floors, along the entire perimeter of the building there is a basement.

Apartment with an area of approx.

L&B Immobiliya

275,000 €

Apartment in Alanya, Turkey

115 m . Both are today considered the most prestigious area that residents of European countries consider for themselves. The area is filled mainly with low-rise buildings, which completely opens up the sky and…

PROFIT REAL ESTATE

92,000 €

Apartment in Leipzig, Germany

49 m 2 1

Renovated apartment in a modern house for own use and for rent! located on the upper attic floor of a modern house built in 1996. In total, the house has three floors and an unorganized attic, along the entire perimeter of the building there is…

L&B Immobiliya

220 132 €

Apartments in Frankfurt am Main, Germany

24 m 2 1

Loan

Serviced apartments in cities like Frankfurt am Main are an ideal option for saving money and getting a secure investment financing from a German bank!

Future residents of the project will be able to enjoy its stylish design, as well as the incomparable view of Frankfurt, which opens from the lounge area on the roof of the building.

Estate-Service24

2,500,000 €

Farm in Pisa, Italy

500 m 2 4 5

Luxury mansion for sale in the picturesque hilly area of Tuscany. The total living area of the villa is 460 sq. m. The main building has a three-story structure; on the ground floor there is a spacious salon for receiving guests, a dining room, a kitchen and a bathroom. Above is the so-called “night” area: four bedrooms and four bathrooms….

Lionard Luxury Real Estate

256,000 €

Chalet in Aguilas, Spain

120 m 2 4 3 3

New residential complex of 14 exclusive 3 bedroom villas, combining modern design, quality and functionality.

The villa consists of one large living room, furnished kitchen, 3 bedrooms, 3 bathrooms and a terrace. Each villa has a separate plot with a terrace, garden, swimming pool and parking.

The residential complex is located in an exclusive…

Albamar Group

19 270,000 €

Villa in Beaulieu-sur-Mer, France

1514 m 2 10 10

Sale of a project for the construction of two adjacent villas in Beausoleil / Beausoleil 5 minutes drive from Monaco. The architecture of the houses will be made in a modern style. Upper villa of 742 sq.m., with a covered terrace of 190 sq.m. The lower villa is 772 sq.m., with a covered terrace of 235 sq.m. The layout of both villas is as follows: entrance hall, large living room/library,…

SERVICEAZUR

4 890 000 €

Villa in Marbella, Spain

455 m 2 6 5 5

Residence permit upon purchase

Loan from 2%

New villa from the developer with direct access to the beach.

Built to the highest standards by a Belgian developer, the home offers high ceilings and spacious open-plan spaces with plenty of natural light. The perfect fusion between interior and exterior.

The layout consists of a living/dining room with…

Cadespa Luxury Real Estate

465,000 €

Villa in Rojales, Spain

236 m 2 3 3

Detached house in Rojales. The villas are designed with a total area of 236m2 overlooking Guardamar and the sea. 3 bedrooms with bathroom and terraces overlooking the mountains. From the infinity pool, you can enjoy the wonderful views and nature that Rojales has to offer. The natural light on the ground floor ensures that you can also make the most of…

OLE INTERNATIONAL HOMES S.L.

219,900 €

Townhouse in Torrevieja, Spain

114 m 2 3 2 2

Costa Invest

445,000 €

Apartment in Athens, Greece

102 m 2 3 2 2

Residence permit upon purchase

102 sqm apartment for sale in Athens.

Mercury Group

88,000 €

Apartments in Alanya, Turkey

45 m 2

Residence permit upon purchase

Online display

Remote transaction

We are pleased to present you a brand new investment project Nova Garden, located in one of the best areas of Alanya – Oba. Nova Garden is a new high quality 5-storey complex consisting of 2 blocks. A total of 63 apartments. In addition to stunning mountain views, it is located close to some important public…

Alanya Property Sales

4 522 708 €

Penthouse in Dubai, UAE

331 m 2 3 3 4

RK PROPERTY REAL ESTATE BROKER

2 250,000 €

Villa in Finestrat, Spain

241 m 2 6 5 5

residence permit upon purchase

Online display

Remote deal

Credit 3-4%

Exclusive luxury villa with breathtaking panoramic views of the sea, mountains and lights of the resort town of Benidorm.

SPAINLUXINVEST

118,001 €

Apartments in Dubai, UAE

39 m 2 1

Online show

Remote deal

Payment in rubles

Luma 21 project located in Jumeirah Village Circle. The area is 422 sq. ft. / 39 sq.m. It is a thriving community offering amazing amenities to its residents.

PROPERTY FEATURES:

1 dedicated parking space

Balcony

Built-in kitchen

Built-in wardrobes

Concierge Services

Mulberry View Community…

Arbat Real Estate

125,000 €

Apartment in Alanya, Turkey

50 m 2 2 1 1

Residence permit upon purchase

Online display

Remote deal

Payment in rubles

Apartment 1 + 1 in Mahmutlar with mountain views, built in 2021, with an area of 50 m².

Zera Homes

227 200 €

Apartment in Kestel, Turkey

115 m 2 3 2

Residence permit upon purchase

Apartment in a new building with good repair and furniture

Renaissance Estate

125,000 €

Apartments in Avsallar, Turkey

120 m 2 4 3

Residence permit upon purchase

Apartment 3 + 1 with two balconies 800 m from the sea. Mountain View.

The residential complex consists of 1 block, 7 floors with 49 apartments on an area of 984.43 m2.

It is built in a place where it dominates the sea and mountain landscapes.

The complex has: indoor swimming pool, children’s pool, zone…

AAAA ADVISER

925 833 €

Apartment in Dubai, UAE

319 m 2 4 3

Luxury residential complex from a reliable developer, located in one of the best areas of Dubai (Business Bay), offers fully furnished apartments with 1, 2 and 3 bedrooms.

Business Bay is one of the most developed and sought after areas in Dubai. The very name of the community speaks of its main purpose:…

AAAA ADVISER

Additional costs when buying property in Ireland

For the calculation, we took an example of a two-bedroom apartment worth €350,000.

5 thousand

5 thousand Estimated maintenance costs

|

Rental income per year |

€30,000 |

|

Property tax |

€497 |

|

Lease registration |

€90 |

|

Insurance |

€300 |

|

Operating expenses |

€2,000 |

|

Management services |

€5 904 |

|

Annual tax returns |

€1 845 |

|

Total expenses per year, incl. VAT |

€10 636 |

Real estate tax

The tax is calculated annually based on the current market value of the apartment in the real estate register.

Lease registration

The law requires landlords to register lease agreements with the Housing Lease Commission. The registration fee of €90 must be paid within one month from the date of conclusion of the contract.

Insurance

Insurance costs vary by property. For the type of property in question, we have estimated the insurance premium at €300 per year. The tenant usually buys separate insurance for his property, and the owner’s insurance will also cover accidental damage to the apartment. The risks of damage to the structural elements of the building are usually covered by special insurance, which is included in the operating costs.

Operating expenses